- 1. The Fed raises short term rates and long term rates decline

- 2. US – Pronounced and Broad-based slowdown in credit growth

- 3. US - Household spending is unlikely to match current expectation levels

- 4. Euro area - Consumption continues to support the favourable growth outlook

- 5. Portugal - Budget deficit brought back to 40-year lows

- 6. UK - The possibility of rate hikes during Brexit negotiations

- 7. India - A positive environment for the Indian rupee

- 8. Volatility – Extreme low levels of volatility in an uncertain context

- 9. Bonds – A volatile month for the high yield market

- 10. Oil – Is the balance between supply and demand still a source of concern?

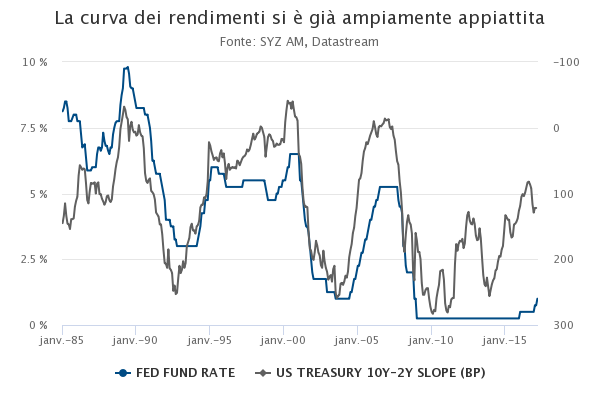

The Fed raises short term rates and long term rates decline

The Federal Reserve raised its Federal Fund rate by 25bp in March. It was not a surprise for financial markets since several Fed members had hinted strongly at a rise in the weeks before. However, what is more surprising is the pronounced rate decline in bond markets. This may be attributed to the Fed maintaining a relatively cautious stance and refraining from raising interest rate projections for the years ahead.

A more structural explanation may lie in the configuration of the yield curve. While the yield curve generally flattens in parallel with the Fed’s rate hikes, it has this time already flattened significantly long before the Fed even started to raise rates. This is probably a reflection of many investor’s lower long-term growth and inflation outlook. The fact that the curve has already flattened may be a sign that the Fed has little reason to raise its short-term rate at this stage of the cycle.

The flattening of the yield curve has already largely happened.

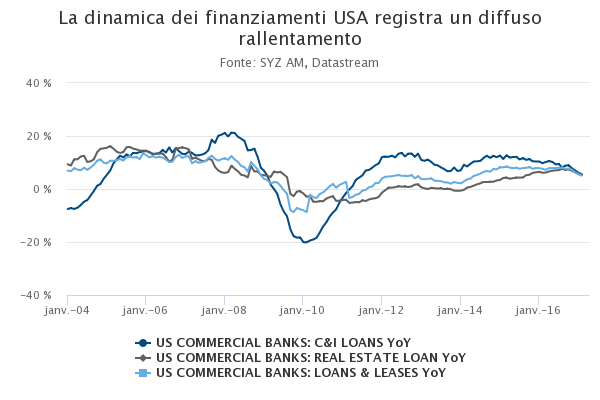

US – Pronounced and Broad-based slowdown in credit growth

The uncertainty around the US economic outlook triggered by the divergence between survey-based indicators and hard data has been further reinforced by a disturbing trend in credit distribution.

Indeed, bank lending growth has been slowing across the board in the past few months, on the corporate side as well as on the household side. The surprised drop in US car sales, which was at a two-year low in March, may already be a consequence of such dynamic.

Rising short and long-term interest rates probably explain part of this credit slowdown. The tightening in banks' lending standards in 2016 is also likely to be an explanation. In any case, such decline in credit growth is a concerning development that is at odds with expectations of an acceleration in the pace of US GDP growth. This might be an illustration of the high sensitivity of economic activity to financing conditions for economies with high levels of very cheap debt.

US lending dynamic is experiencing a broad-based slowdown.

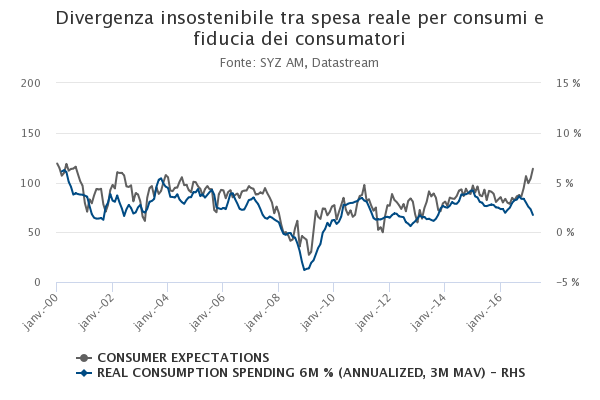

US - Household spending is unlikely to match current expectation levels

Consumer sentiment and household consumption tend to move very logically in tandem. However, since the end of last year, a surprising divergence has appeared in the US. Consumer expectations have surged to their highest level since 2000, while growth of real consumer spending has slowed to its weakest pace in more than three years.

The oil-led acceleration in inflation has certainly played a role by eroding households' purchasing power. This impact on consumption growth is likely to be transitory, and low unemployment rates and rising wages will continue to support spending growth.

However, taking into account the ongoing slowdown in consumer credit, it seems highly unlikely that US consumption will all of a sudden sharply reaccelerate towards levels suggested by consumer confidence indicators. The confidence surveys seem to paint an excessively rosy picture of the growth outlook, driven by overly optimistic expectations around promised tax cuts. The two diverging lines appear due to converge somewhere in the middle of the current gap.

Unsustainable divergence between real consumer spending and consumer confidence.

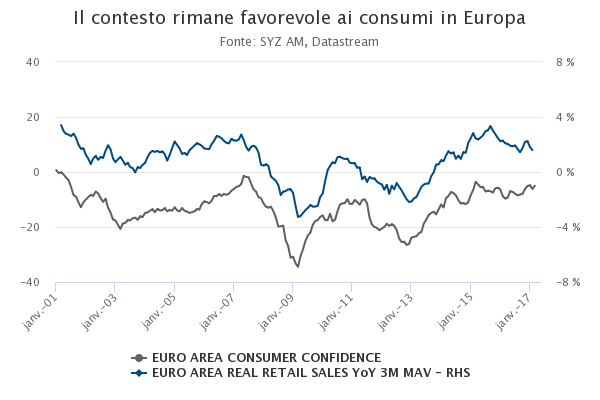

Euro area - Consumption continues to support the favourable growth outlook

Unlike in the US, consumer confidence and household spending have not diverged meaningfully in Europe recently. Real retail sales have slowed down somewhat in H2 2016 because of the negative impact of rising oil prices, but their growth rate has remained at levels consistent with solid GDP growth for the Euro area.

Consumption dynamic is currently fuelled and sustained by positive job market dynamics, with declining unemployment rates, and accommodative financing conditions that support consumer credit and real estate prices.

In this context, the elevated level of consumer confidence appears to be based on facts rather than on hope. The confidence increase in March after the modest pullback in February points to a rebound in European consumption in the months ahead after the slowdown of 2016. This continues to support the positive growth outlook for the Euro area, as long as political risk doesn’t materialise.

The environment remains favourable for consumption in Europe.

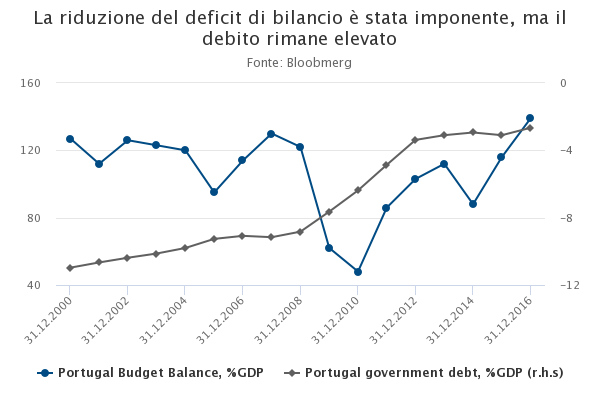

Portugal - Budget deficit brought back to 40-year lows

The Portuguese prime minister, Antoniò Costa, is on the right track to showing that turning the page on austerity was a suitable alternative for the country. The government has announced this month that it cut the budget deficit to 2.1% of GDP for 2016. This is the first time in 40 years and now brings the deficit under the 2.5% target set by the European Union.

Despite an elevated level of public debt (126% of GDP) that is still a source of continuing concern, Portugal may soon join Ireland and Spain in the club of countries that succeeded the turnaround in the Euro zone’s periphery. The economy has grown over the last four quarters (2% on an annualised rate) and unemployment dropped from 17% at its peak to 10.5%

Portugal now expects to get its exit ticket from the excessive deficit procedure that could trigger a credit rating upgrade and reduce government borrowing costs.

Impressive reduction of the budget deficit, but still an elevated debt.

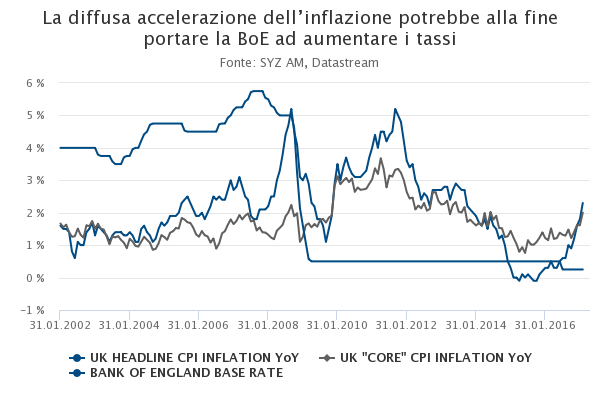

UK - The possibility of rate hikes during Brexit negotiations

Nine months after the referendum, the British government has formally started the Brexit process by triggering Article 50 of the Treaty on the European Union. This opens a two-year negotiation period to settle divorce.

Beside politics, developments in the UK are raising unexpected uncertainty around the monetary policy outlook. Economic activity so far defies gloomy pre-referendum previsions, with yearly GDP growth stable around 2%. Inflation now exceeds the 2% target, not only because of energy-related base effects but also due to GBP weakness pushing up prices across the board.

Such context appears at odds with the very accommodative stance of the BoE. Calls for a monetary policy adjustment emerge, as highlighted by the vote for a rate hike in March casted by one of the nine members of the BoE. If current growth and inflation dynamics continue to prevail, the central bank might have to raise rates sooner than initially thought, potentially providing unexpected support to the GBP.

Broad-based inflation acceleration might eventually encourage the BoE to raise rates.

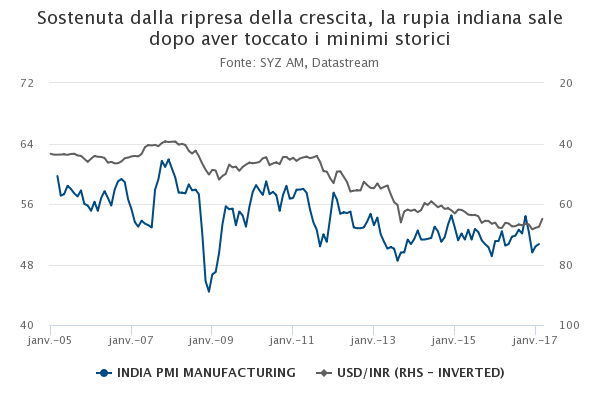

India - A positive environment for the Indian rupee

The demonetisation reform had caused a sudden and pronounced slowdown in India's economic activity at the end of last year. However, since the beginning of this year, indicators point to a gradual recovery and suggest that the impact should not be long-lasting, thanks to stabilising consumption. In the meantime, the central bank has refrained from continuing to ease its monetary policy, shifting to a more neutral stance as inflation appears to pick up.

In parallel, after falling back towards its all-time low against the dollar last November, the Indian rupee has rebounded and is up 5% in 2017. The landslide victory of the Prime Minister's party in the most populated State of India has fuelled the trend as this proved that Modi still enjoys strong popular support despite the criticised demonetisation reform. Recovering growth, sound monetary policy, political continuity on a reform agenda and almost-balanced external accounts provide a supportive environment for the currency.

INR rebound after an all-time low, supported by recovering growth.

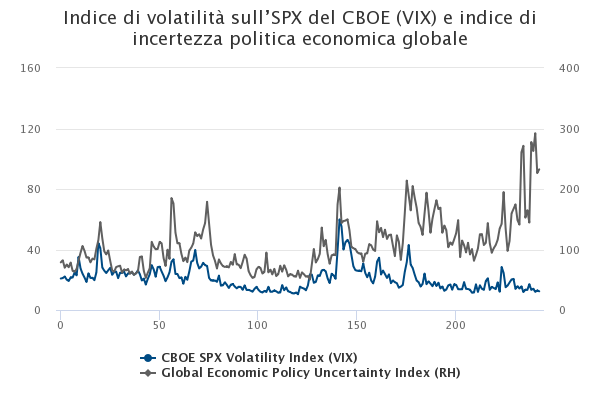

Volatility – Extreme low levels of volatility in an uncertain context

At the end of this first quarter, volatility (in the US but also in Europe) has been surprisingly very low. Therefore, cheapness of implied equity volatility can be found in the US with the VIX troughing at 11.0% in March. Moreover, the highest level reached by the VIX in 2017 stands at 15.1, while if we look back to history data from nine years ago,)it ranges from 21.5 to 57.4.

On one hand, global economic policy is hovering at high levels (near 20-year highs) and on the other hand the VIX is nearing 20-year lows. Usually as economic policy uncertainty moves higher, the VIX moves higher with it.

Since the defeat of Donald Trump over his plan to repeal and replace Obamacare, which was one of his election promises, equity volatility measures have clearly started to edge higher. Yet they remain at very low levels, continuing to suggest a fair level of complacency around potential risks by market participants.

Going forward, the French elections could be the next event that could trigger an upward movement in volatility and close this gap as soon as the end of April.

CBOE SPX Volatility Index (VIX) and Global Economic Policy Uncertainty Index.

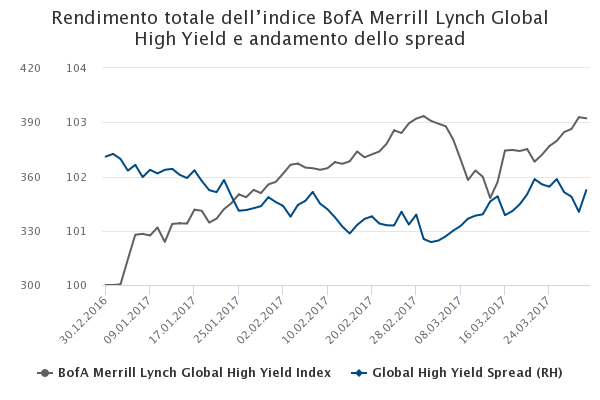

Bonds – A volatile month for the high yield market

March demonstrated one of the strongest movements in terms of spreads widening in the high yield market, before recovering in the last days of the month. The premium that investors are demanding to hold riskier corporate bonds has climbed to the highest level since the election of Donald Trump . High yield spreads have widened as much as 19.6 bps before tightening towards the end of the month and finishing 13 bps wider, which translates to a nil return for the asset class in line with the US broad market.

Political uncertainty, particularly in the Netherlands and in France, has clearly weighted on this riskier fixed income segment. Moreover, the Fed meeting (mid-month) was a turning point as, alongside a fully discounted 25bp rate hike, the Fed managed to deliver a balanced message, which wrong-footed market expectations of a hawkish adjustment to projections. In this context, credit side and spreads edged marginally higher.

The drop in oil prices weighted on US energy names, especially in the US high yield space. Finally, compared to last year’s levels, this spread is still much narrower than where it used to be, mainly because of a rebound in the oil price and a better economic outlook.

BofA Merrill Lynch Global High Yield Index Total Return and Spread evolution.

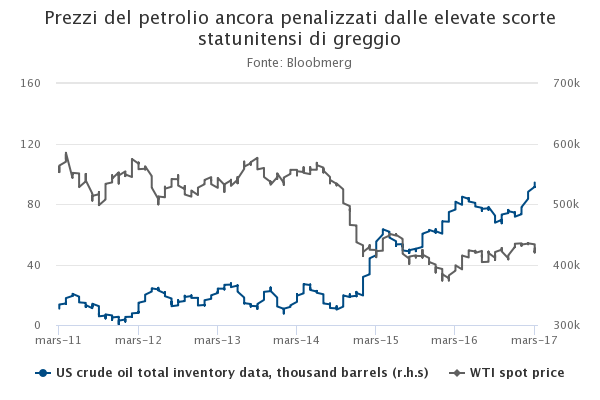

Oil – Is the balance between supply and demand still a source of concern?

The oil market faced a more volatile environment in March with oil prices edging lower (-6.3% for the WTI and -5% for the Brent). While the agreement of oil production cuts between OPEC and non-OPEC producers late last year helped to boost prices until February, the path towards seeing the oil market back in balance appears not to be so straightforward.

Despite the deal on production cuts, designed to drain the oil glut, worldwide oil inventories remain elevated. In the US, the total crude inventory stands at a record high with 534 MMbbls weighing in on oil prices. The recovery of the US shale, as illustrated by the increase in active rigs, also counteracts efforts from OPEC and tends to undermine oil prices.

However, an extension of the OPEC deal beyond June, combined with signs suggesting that the energy demand from Asia would remain solid going forward, should continue to support the demand for petroleum products and thus the oil prices.

Oil prices still undermined by high US crude inventories.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)