Assuming it goes through, the deal will create a global leader in project, engineering and technical services delivery. The industrial logic is compelling given complementary business models and the availability of material cost synergies (>14% of combined 2016E EBITA). It will therefore be significantly earnings enhancing and combined net debt will be $1.6b, implying a manageable 1.9x net debt-to-EBITDA which is then expected to decline to a more appropriate 0.5x -1.5x within 18 months of completion.

Amec Foster Wheeler to be acquired at a 30% premium by Wood Group

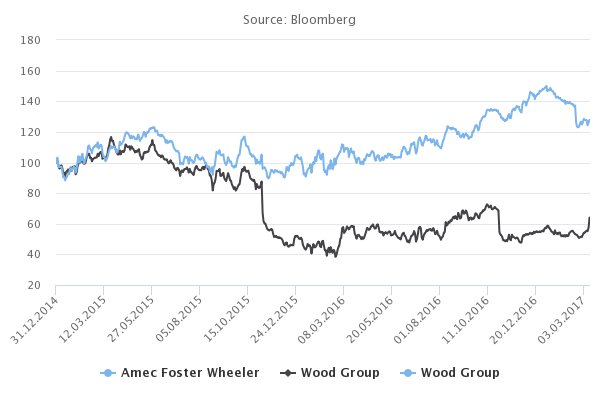

Tuesday, 03/14/2017Wood Group surprised the market by announcing an equity-financed bid for Amec Foster Wheeler at a price of 564p, a 28.7% premium to its 3-month average. Although the deal instantly fixes Amec Foster Wheeler’s balance sheet, this wasn’t through the rights issue that we had anticipated. Nonetheless, Wood Group’s shrewd move highlights the longer-term underlying value we identified in Amec Foster Wheeler’s shares.

Given what remains a challenging environment for oil and gas activity, further cost cutting via industry consolidation appears inevitable for the sector.

Strong strategic rationale

Opportunistic timing

Wood Group has a highly successful track record of value creation through well timed acquisitions, and this appears to be another clever deal by the Scots towards the bottom of the cycle. Prior to the bid, Amec Foster Wheeler had underperformed Wood Group by c.70% since 2015, which suggests that now is an attractive time for Wood to make its move. Indeed, the large fall in Amec Foster Wheeler’s share price in November 2015 provided us with the opportunity to initiate a position at ‘bombed-out’ levels. While we do not view the offer price as reflective of Amec Foster Wheeler’s longer-term underlying value, Amec Foster Wheeler shareholders will own 44% of the combined entity which will still enable participation in the turn-around of the company, the significant synergies and scale benefits, and the potential upturn in the cycle.

Counter bid on the cards?

In the wake of the announcement, it would not surprise us if some of the other globally diversified engineering companies were to ‘run the rule’ over Amec Foster Wheeler. Even though Amec Foster Wheeler has recommended the offer, several peers (such as SNC Lavalin, Fluor and Jacobs) have the balance sheet capacity and ability to make compelling cost synergy arguments, which could sway the board to accept a higher rival offer. Given what remains a challenging environment for oil and gas activity, further cost cutting via industry consolidation appears inevitable for the sector.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)