Equity markets and risk assets in general continue to defy fundamental valuation gravity. Even if we can’t really speak about a complete irrational exuberance, markets are clearly pricing in a perfect world where economic and earnings growth may only surprise on the upside, inflation pressures do not exist, central banks will continue to sit on the accommodative side for ever and political risk will never materialise. The lofty valuation of US technology companies is an emblematic sign of virtual disconnection with the reality of our challenging world. This bears the question, are investors walking on egg shells? In the meantime, US treasuries walk for sure on their head! Indeed, there is something surprising about the lack of reaction of the latter given the increasingly hawkish tone in the Fed’s recent comments to the inflation figures that came out above expectations. There has also been further acceleration in leading indicators, confidence surveys and economic activity in the US according to the latest data. Either the bond market has already anticipated a large part of the cyclical upturn and its consequences on the monetary policy of the Fed - quite possible given the already extremely speculative net short positioning on US treasury futures – or there is some form of complacency or blindness that now reigns in the bond markets? Where are the vigilantes?

At the same time, there are few financial assets that can act as a parachute in the portfolios in the event of a risk-off scenario, and whose valuations have become more attractive since the US election. Thus, the additional value of US treasury bonds, in terms of adjusted risk returns in a balanced portfolio has improved significantly allowing investors, including purely quantitative funds, to continue to add risk assets such as stocks, HY debt and emerging currencies by diluting their volatility and inherent risk with a large dose of these bonds. Magic isn’t? Until then there will be a significant change in the volatility of one of these major asset classes and/or in the correlation among them. The more time that passes, the more the mixture becomes larger and less stable.

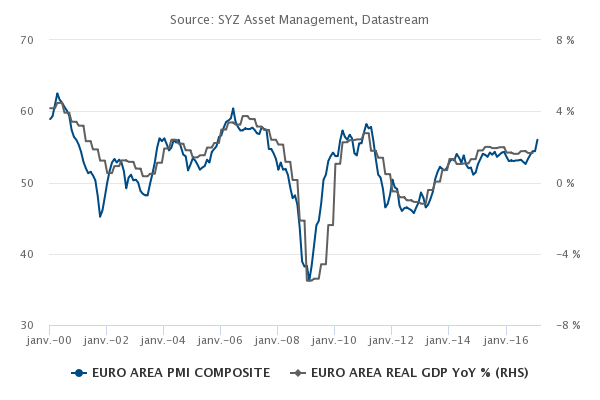

It may indeed be too early to worry because inflation does not seem ready to appear in the Western world and the economy shows no sign of shortness of breath as the first round of the French presidential elections approaches. Or maybe not. Anyway, we do not want to chase rising markets that are not backed by fundamentally good reasons, based on both economic background (which for now seems fine) and valuation purposes (where we get concerned). We prefer to be quite selective in the way we are allocating our risk budget, focusing on areas where we feel remunerated for the risks. For the more adventurous, I will let you meditate on the following adages, hoping that it will either be good advice to you or failing that it will also torment you. “The trees do not go up to the sky” and “No one ever died of having sold too early”.

_Fabrizio Quirighetti